Q: I was told this by a Realtor before seeing a house. I wanted to check to see if you have already received your pre-approval letter or do we need to work on that? Do you have to have some kind of papers before they show you a home? Please explain this, because this is my first time looking into this. I am tried of paying rent to the apartment complex where I have lived for 14 Years. So if you have any suggestions how to go about his process I would really appreciate it very much. Thank You.

–Joyce H.,

A: Dear First-Time Buyer,

There is a fantastic book called “100 Questions Every First-Time Home Buyer Should Ask” by Ilyce R. Glink, ISBN 1-4000-8197-1. I strongly suggest reading it. In the meantime, I will attempt to answer your questions.

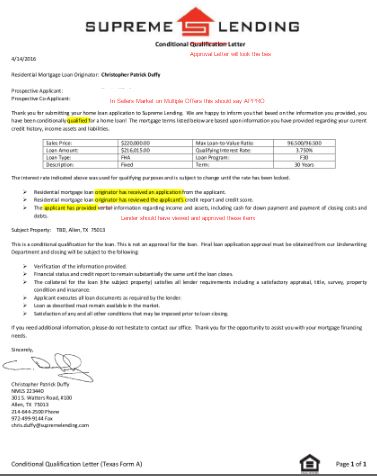

All agents are “allowed” to show you homes, even if you do not have a “pre-approval” letter. By the way, when they refer to a pre-approval letter, they mean a letter from your lender, written on the lender’s letterhead, stating you are approved for a loan of a specific dollar amount.

Most skilled Realtors require their buyers to meet with a lender before looking at homes. The reason for this is that you need to know IF you can really buy a home. Unless you have cash to make your purchase, you need a loan. They only way to know for sure that you can get a home loan, is to meet with a lender. Either meet with a loan broker (they work with 100’s of lenders) or work with a bank (they offer only their own loan programs). Some banks, like Wells Fargo, for example, will even give you a “priority buyer” letter, which puts you on a fast-track to get your loan closed quickly once you find a home.

Usually a potential lender will ask you to fill out a form (application) over the phone, online, or in person. They will also want to run a credit check to get your FICO score and verify your income/expenses. Once they’ve done that, they can determine what type of loan you qualify for, if any. Assuming you qualify for a loan, ask your lender for a pre-approval letter showing how much you qualify for.

Once you have your pre-approval letter from your lender, it will be time to start house-hunting. Don’t waste your time trying to look for homes without knowing how much you can spend on a home and how much your monthly payments will be.

Then, when you are ready to look for homes, interview at least 3 Realtors. Make sure the real estate agent is also a Realtor, as Realtors voluntarily agree to abide by a stricter code of ethics.

The other bit of advice I suggest is to get your own Buyer Agent; never use the listing agent. The listing agent is the real estate agent representing the seller. Have your own agent, focused on your needs, not the seller’s needs. It costs you nothing to have your own Realtor, so be sure to hire a Realtor who does not “double-end” deals. You want a Realtor who only represents one side: Buyer or Seller, not both.

If you know a Realtor from another state, like me for instance, ask that Realtor to find you someone he/she trusts and include that person in your interview process. If you end up choosing that agent, you will be able to get a second opinion/bounce questions off the Realtor you already knew too.

I genuinely hope this information is helpful. Unfortunately this site does not allow me to provide my contact information, so I cannot immediately help you find the right Realtor or lenders.

Sincerely,

DeniseTheRealtor

DRE Lic No 01481788

A: Hello Joyce,

The first step in purchasing a home is to get qualified by a lender so you know how much house you can afford. There is no sense in wasting your own time and that of an agent to see homes until you are ready to purchase. Call a good lender or ask your agent (find a good buyers agent in your area) and get your ducks in a row BEFORE looking at homes. Then when you see something you like you can act on it! Good luck! Also realtor.com has many resources for home buyers FYI!

Five Easy Steps

Purchasing a home can be exciting as well as frightening. Below are the steps it takes to find and get a mortgage. Step by step, it is as easy as one, two, three, four, five!

Step 1. (60-40 Days from Closing)

The Pre-Qualification Process

This is an excellent time to begin the pre-qualification process. Pre-qualifying can mean several things depending on the lender that you choose, but generally it involves knowing the following points- the area you want to live, the type of home you want, and the loan that best fits your financial needs.

Many lenders will pre-qualify you for free. A simple call, with no obligation will allow you to know the type of loan that is best for you.

There are hundreds of loans available, so you should know your best options. The lender will also ask if they can pull your credit report. This report will alert the lender to any credit/financial problems. If you've experienced any financial difficulties (many of us have), you should explain that to the lender so they can provide the best alternatives for you. Next, the lender will most likely ask you a number of questions regarding other things about your life such as employment history, saving habits, marital status, ownership of additional properties, and many other questions to help them determine your ability to repay the loan. This is standard procedure in the mortgage process, so please don't be alarmed.

Read More

PREQUALIFIED VS. PREAPPROVED

Prequalified

Prequalification is the estimation of your borrowing power from a lender and can be accomplished with a simple phone call. Remember, becoming qualified does not necessarily mean that you will be approved for a loan of that amount. In a competitive seller’s market, an offer from a buyer with a pre-qualification letter could lose out to a person who is pre-approved.

Preapproved

A written commitment issued by a lender after a comprehensive analysis of the creditworthiness of the applicant, including verification of income, resources, and other such matters as is typically done as part of a normal credit evaluation program.

By getting preapproved, you know exactly how much home you can afford. Determining how much you can afford before you begin your home search will save you valuable time. There is nothing worse than finding your dream home, only to find out that you cannot qualify for a loan to buy it. A prepproval also strengthens your bargaining power when negotiating with a seller. When you find a property you want to buy, your offer will be in a better positioned than someone less prepared. Finally, being pre-approved is more efficient; it reduces the amount of time it will take your lender to fund your loan. Be prepared to provide comprehensive documentation, which the lender may independently verify, including but not limited to:

- Job & Career Status

- Income

- Monthly Debt Payments

- Cash Available

- Total Assests & Debts

Click the link below to view the Prequalifying letter

Prequalifying Letter